rfu Rating Methodology for Corporates (rfu Corporate Rating)

Investors are specifically looking to invest in sustainable companies via stocks, bonds and other financial instruments. The basis for these decisions are sustainability ratings. The rfu rating model for corporates has its origins in the late 1990s. Optimised by inputs from the scientific community and more than thousandfold practical application. Today, the model represents one of the most mature tools for external rating of corporate sustainability.

The model’s basic structure is a matrix made up of six stakeholder groups and four managerial levels including products and services. Each intersection of the matrix forms a rating field, to which criteria are assigned. On the whole, the model contains almost 100 individual criteria, which are operationalised by approx. 400 quantitative and qualitative indicators. Weighting of the individual rating fields depends on the relevance for the respective company (e.g. affiliation to a sector or position in the value chain). The final output is a sustainability rating on the rfu rating scale as well as a statement on the applicability of exclusion criteria.

Rating Scale

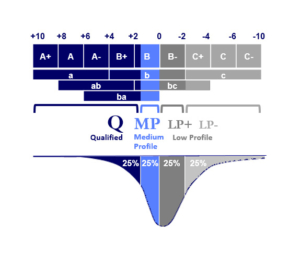

In all rfu Sustainability Models the individual criteria are assessed on a scale between -10 to +10. Their specific weighting is then included in an overall score. The features of the criteria will, over several levels, be aggregated to one overall rating on a nine-part scale from A+ (“innovative”) to C- (“regressive”). In case of a restricted amount of data a so-called indicative rating from a to c will be given.

The rfu Rating Scale is absolute and not aligned with the best-in-class approach. This means the entirety of the ratings is distributed according to a profile similar to a bell curve. This can be divided in four equal segments to achieve so-called rating categories: Q (Qualified), MP (Medium Profile), LP+ und LP- (Low Profile).

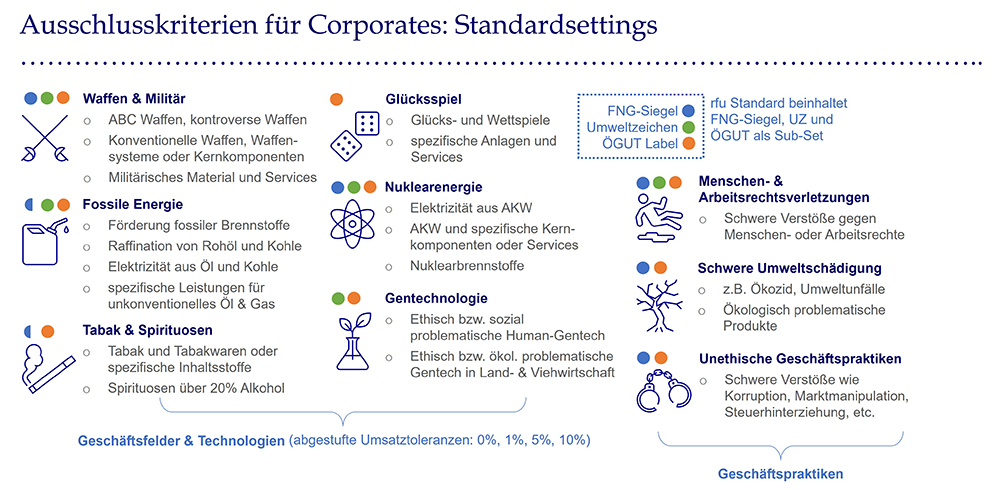

Exclusion Criteria

For companies as well as for countries there are activities and behaviour patterns contradicting the principles of sustainability. These are covered by the exclusion criteria. The so-called rfu Standard contains all those exclusions necessary to fulfill important external requirements (Österreichisches Umweltzeichen, FNG-Siegel, ÖGUT-Zertifizierung). Additionally, other Standards can be chosen (e.g. FinAnKo for church investors) or clients can apply completely individual settings.