rfu Rating Methodology for Sovereigns (rfu Sovereign Rating)

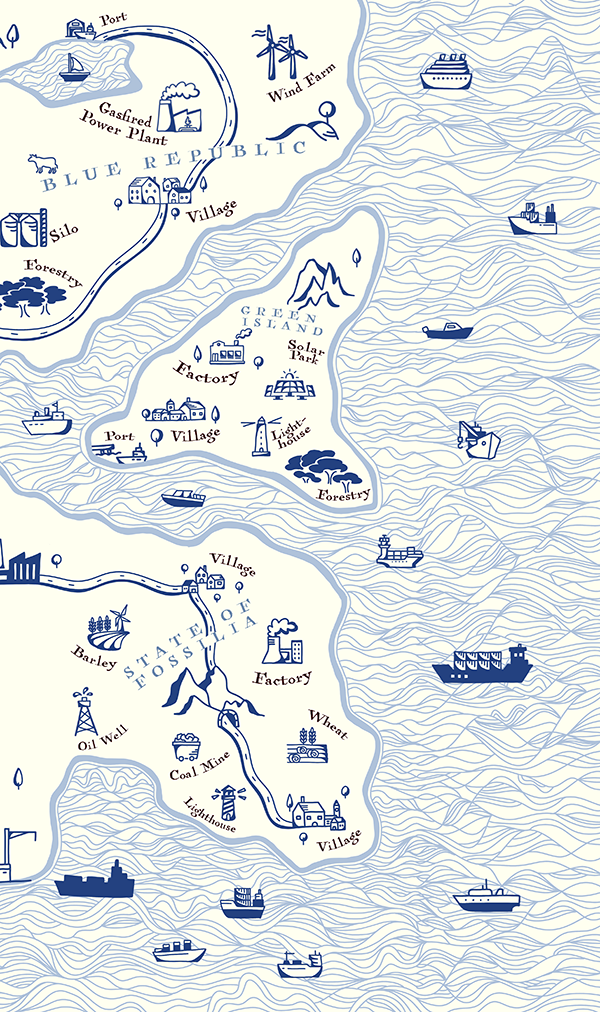

Countries are creating social frameworks and are themselves actors in various political fields. Any method for analysing sovereigns has to be able to assess their performance in the context of different socio-economical and natural conditions. Aiming to create a scientifically sound and at the same time practicable and meaningful basis for decision making the rfus Rating Methodology for Sovereign was first developed in 2015. It has been continuously optimised since then.

The rating methodology is based on the classic three-pillar-model of sustainability: society, environment and economy. Recognised scientific concepts were selected for the derivation of specific criteria on the next level. For the social and economic pillar, the fundamental human needs theory of Manfred Max-Neef and the system-theoretical approach of Hartmut Bossel were used. The ecological pillar is oriented on the planetary boundary concept of the Stockholm Resilience Center. In total, the method is looking at over 100 criteria as well as a multitude of related indicators which it aggregates into an overall rating on the rfu rating scale. Additionally, exclusion criteria can be applied.

Downloads

Here you can download information about the rfu Model for Sovereigns as a PDF.

rfu rating methodology for sub-sovereigns (rfu Sub-Sovereign Rating)

Sub-sovereigns – i.e. public authorities below the country level such as states and cities – are increasingly active on the capital market with their own bond emissions. From the viewpoint of many sustainable investors the so far usual approach to equate the ESG-rating for the member state to the motherland is only an inadequate approximation.

Therefore in 2021/2022, rfu developed a methodology for sub-sovereigns as an additional function of the sovereign rating. First of all, it is identified how much discretion the entity has . Within this leeway social and ecological achievements are then assessed separately, leading to either a lesser or better rating compared to that of the motherland. Especially in Emerging Markets this can lead to new investment potentials for sustainable investors.

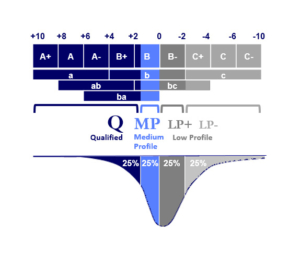

Rating Scale

In all rfu Sustainability Models the individual criteria are assessed on a scale between -10 to +10. Their specific weighting is then included in an overall score. The features of the criteria will, over several levels, be aggregated to one overall rating on a nine-part scale from A+ (“innovative”) to C- (“regressive”). In case of a restricted amount of data a so-called indicative rating from a to c will be given.

The rfu Rating Scale is absolute and not aligned with the best-in-class approach. This means the entirety of the ratings is distributed according to a profile similar to a bell curve. This can be divided in four equal segments to achieve so-called rating categories: Q (Qualified), MP (Medium Profile), LP+ und LP- (Low Profile).

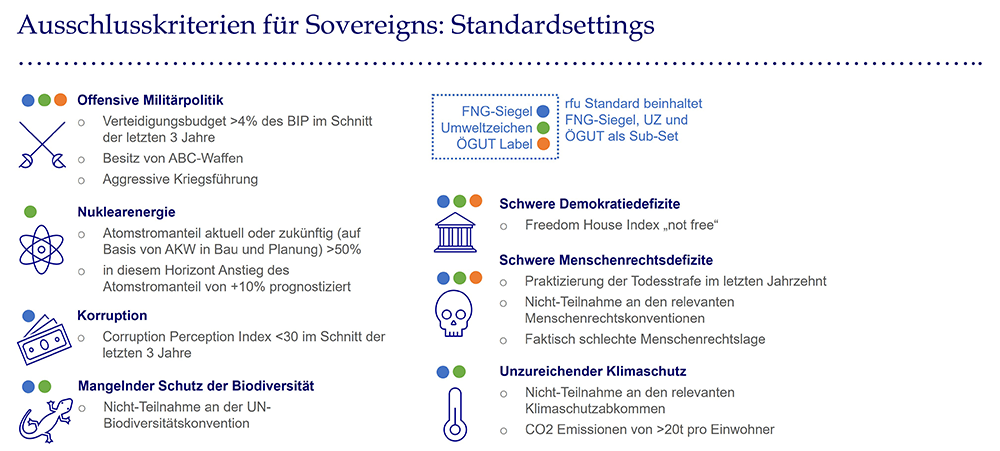

Exclusion Criteria

For companies as well as for countries there are activities and behaviour patterns contradicting the principles of sustainability. These are covered by the exclusion criteria. The so-called rfu Standard contains all those exclusions necessary to fulfill important external requirements (Österreichisches Umweltzeichen, FNG-Siegel, ÖGUT-Zertifizierung). Additionally, other Standards can be chosen (e.g. FinAnKo for church investors) or clients can apply completely individual settings.